matctv.ru

Community

Florida Power & Light Stock Price

NextEra Energy, Inc. is an energy company and is one of the largest electric power generators in the United States. Through its Florida Power & Light. Energy Resources, LLC and NextEra Energy Transmission, LLC (collectively, NEER) and Florida Power & Light Company (FPL). Its segments include NEER and FPL. FPL. The price change percentage of Florida Power & Light Co over the last month is N/A%. The Stock Performance of Florida Power & Light Co is significantly lower. Through its Florida Power & Light Company (FPL) business, the company provides clean, reliable and affordable electricity across Florida. NextEra Energy. NYSE: DUK · Price. $ · Volume. 20 · Change. · % Change. % · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. Number of shares of Florida Power & Light Company common stock, without par In that event, the market price for the securities of NEE or FPL could decline. As of the end of day on the Aug 02, , the price of an First Trust New Opportunities MLP & Energy Fund (FPL) share was $ Search matctv.ru to quickly find information about stocks and/or options research reports, news and analytical data. Find the latest NextEra Energy, Inc. (NEE) stock quote, history, news and other vital information to help you with your stock trading and investing. NextEra Energy, Inc. is an energy company and is one of the largest electric power generators in the United States. Through its Florida Power & Light. Energy Resources, LLC and NextEra Energy Transmission, LLC (collectively, NEER) and Florida Power & Light Company (FPL). Its segments include NEER and FPL. FPL. The price change percentage of Florida Power & Light Co over the last month is N/A%. The Stock Performance of Florida Power & Light Co is significantly lower. Through its Florida Power & Light Company (FPL) business, the company provides clean, reliable and affordable electricity across Florida. NextEra Energy. NYSE: DUK · Price. $ · Volume. 20 · Change. · % Change. % · Today's Open. $ · Previous Close. $ · Intraday High. $ · Intraday Low. Number of shares of Florida Power & Light Company common stock, without par In that event, the market price for the securities of NEE or FPL could decline. As of the end of day on the Aug 02, , the price of an First Trust New Opportunities MLP & Energy Fund (FPL) share was $ Search matctv.ru to quickly find information about stocks and/or options research reports, news and analytical data. Find the latest NextEra Energy, Inc. (NEE) stock quote, history, news and other vital information to help you with your stock trading and investing.

Nextera Energy Inc NEE:NYSE ; Open ; Day High ; Day Low ; Prev Close ; 52 Week High

Get Nextera Energy Inc (NEE.P) real-time stock quotes, news, price and Florida Power & Light Company (FPL). Its segments include NEER and FPL. FPL. Get powerful stock screeners & detailed portfolio analysis. Subscribe NowSee Plans & Pricing · ios android. TipRanks is a comprehensive research tool. shares is based on the market price of FPL Group's common stock when the related performance goal is achieved. (2) Shares of restricted stock were issued at. Number of shares of Florida Power & Light Company common stock, w~out par value. price movements and changes in the expected volatility of prices in the. ; Volume: M · 65 Day Avg: M ; Day Range ; 52 Week Range Its subsidiaries include Florida Power & Light, NextEra Energy Resources, NextEra Energy Partners, Gulf Power Company, and NextEra Energy Services. FPL, the. NextEra Energy Share Price Live Today:Get the Live stock price of NEE Inc Florida Power & Light Company (FPL) is a rate-regulated electric utility. Get Nextera Energy Inc (NEE.N) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. NextEra Energy stock price, live market quote, shares value, historical data Florida Power & Light Company (FPL) is a rate-regulated electric utility. NextEra Energy's regulated utility, Florida Power & Light, is the largest rate-regulated utility in Florida. The utility distributes power to nearly 6. Historical Price Lookup · Company Overview · News & Events · News Releases · Events & Presentations · Reports & Filings · Quarterly Financial Results · SEC Filings. See the latest NextEra Energy Inc NEE stock price (NYSE: NEE), related news, valuation, dividends and more to help you make your investing decisions. Florida Power & Light Company (FPL), the principal subsidiary of NextEra Energy Inc. (formerly FPL Group, Inc.), is the largest power utility in Florida. USEV58 ; End-of-day quote Nyse ; - · , Intraday chart for Florida Power & Light Company. USFM41 - Florida Power & Light Co. Stock - Stock Price, Institutional Ownership, Shareholders. The latest closing stock price for NextEra Energy as of September 05, is The all-time high NextEra Energy stock closing price was on December. stock price multiplied by the number of shares outstanding. NextEra Energy NextEra Energy's primary subsidiaries are Florida Power & Light Company. Stock Price, News, Quote and Profile of NEXTERA ENERGY INC(NYSE:NEE) stock Florida Power & Light Company (FPL). Its segments include NEER and FPL. FPL. NextEra Energy, Inc. is an electric power and energy infrastructure company. It operates through the following segments: FPL & NEER. With nearly charging points available in Florida, see how easy FPL EVolution makes it to find an EV charging station whether you're near home or on a.

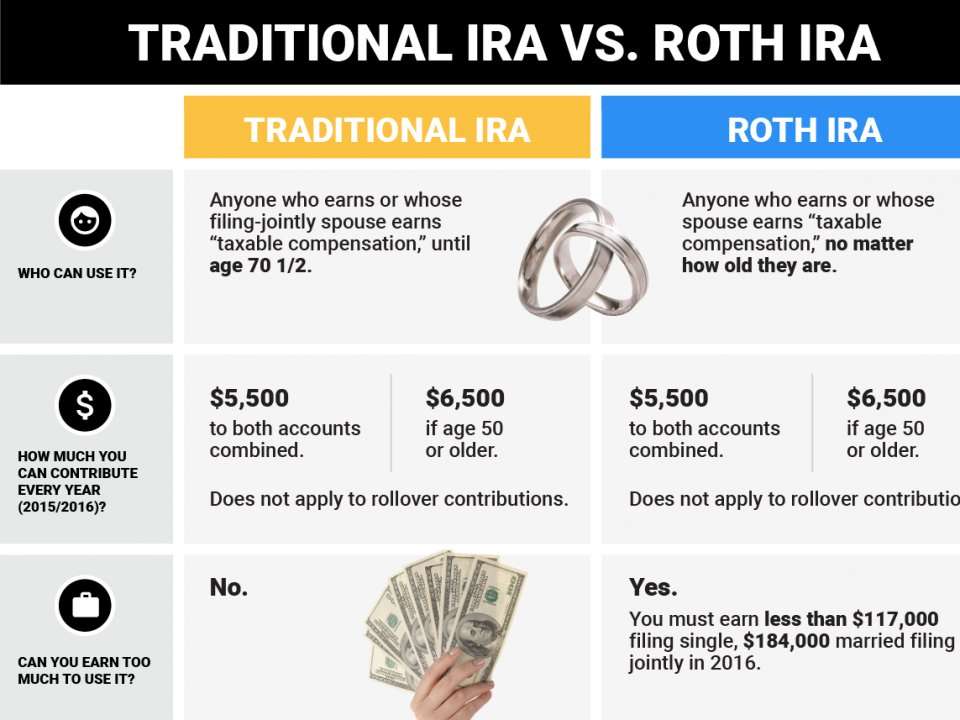

Traditional Ira Trading Rules

bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. Manage your retirement investments with a Wells Fargo Advisors WellsTrade® IRA for $0 per online stock and ETF tradeFootnote 1. Compare Roth and Traditional. A traditional IRA allows any investment earnings to grow tax deferred until withdrawn, typically at retirement. A traditional IRA is a type of retirement account that may allow you to receive a tax deduction when you contribute money. Then, during retirement, your. Rules · Withdrawals from Traditional IRAs cannot be made before age 59 ½ (without penalty), with required minimum distributions starting at age 70 ½. · A 10%. For example: if your Traditional IRA funded 75 percent of the purchase, 75 percent of the proceeds must go back into that IRA. If you financed a portion of the. Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees associated. What tax rules do IRA accounts have? ; Age 59½ Rule, Withdrawals before age 59½ are subject to a 10% tax plus any tax associated with your gross income. If you trade using unsettled funds, it could trigger pattern day trader rules. Day trading activities should be avoided inside retirement accounts given the. bank or other financial institution; life insurance company; mutual fund; stockbroker. Types of IRAs. A traditional IRA is a tax-advantaged personal savings. Manage your retirement investments with a Wells Fargo Advisors WellsTrade® IRA for $0 per online stock and ETF tradeFootnote 1. Compare Roth and Traditional. A traditional IRA allows any investment earnings to grow tax deferred until withdrawn, typically at retirement. A traditional IRA is a type of retirement account that may allow you to receive a tax deduction when you contribute money. Then, during retirement, your. Rules · Withdrawals from Traditional IRAs cannot be made before age 59 ½ (without penalty), with required minimum distributions starting at age 70 ½. · A 10%. For example: if your Traditional IRA funded 75 percent of the purchase, 75 percent of the proceeds must go back into that IRA. If you financed a portion of the. Merrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge® Self-Directed brokerage account. Brokerage fees associated. What tax rules do IRA accounts have? ; Age 59½ Rule, Withdrawals before age 59½ are subject to a 10% tax plus any tax associated with your gross income. If you trade using unsettled funds, it could trigger pattern day trader rules. Day trading activities should be avoided inside retirement accounts given the.

Using an IRA to trade can help you postpone paying taxes on the profits earned from the sale of stocks, and it eliminates the need for tax reporting. Trading. Traditional IRAs: If you withdraw funds from your traditional IRA before age 59 and a half, you are taxed at your current income tax rate and you are charged a. Individual Retirement Accounts (IRAs) · Traditional IRA. Contributions typically are tax-deductible. · Roth IRA. Contributions are made with after-tax funds and. A traditional IRA is an account that's eligible for persons with earned income, or who file a joint return with a spouse who earns an income. Tax-deferred. There are also rules around traditional and Roth IRA withdrawals. Traditional vs. Roth IRA. Both traditional and Roth IRAs have penalties for early withdrawals. trading in shares of the ETF. While the Proxy Portfolio includes some of the Learn about the features, rules, and limits of Traditional IRAs here. IRA withdrawal rules Will I pay taxes on withdrawals? You'll never pay taxes on withdrawals of your Roth IRA contributions. And you won't pay taxes on. However, with an IRA margin account you can utilize settlement margin which allows you to trade on unsettled funds as much as you want. Can I Short? No, you. You can withdraw earnings penalty-free at age 59½, or earlier for certain hardships, as long as you've followed the rules of a Roth IRA. You're not required. IRA accounts may be opened in any base currency, but when trading in a non-base currency product, a currency trade must be executed first as you cannot borrow. However, if you trade with limited margin—keeping a minimum of $25, equity in your account—you can avoid trading restrictions or potential good faith. In most cases, contributions to traditional IRAs are tax deductible. So, if you put $4, into an IRA, your taxable income for the year decreases by that. Traditional IRA Rules · All earnings and deductible contributions are taxable upon withdrawal. · Penalties will be incurred if withdrawals are taken before age. Trading stocks in an IRA requires setting up a brokerage account specifically for IRA trading. While trading stocks and most ETFs in an IRA typically incurs no. Unlike Roth IRAs, which you fund with after-tax dollars in exchange for tax-free income in retirement, a traditional IRA offers the potential to save on taxes. Traditional IRAs may be a good choice if you are seeking a possible tax deduction, your income is too high to be eligible for a Roth IRA, or you believe you. You can open a Traditional IRA in a mutual fund or in an exchange-traded fund (ETF) or other investment vehicle through our brokerage service. Mutual Funds. According to IRS guidelines, if your IRA engages in a prohibited transaction, your IRA ceases to exist. It becomes distributed, and you may have to pay taxes. The traditional IRA is one of the best options in the retirement-savings toolbox. You can open a traditional IRA at a bank or a brokerage, and the universe. All income from IRA assets must be put back in the IRA. 3. Disallowed Investments. The IRA investor cannot invest in disallowed assets per IRS rules for.

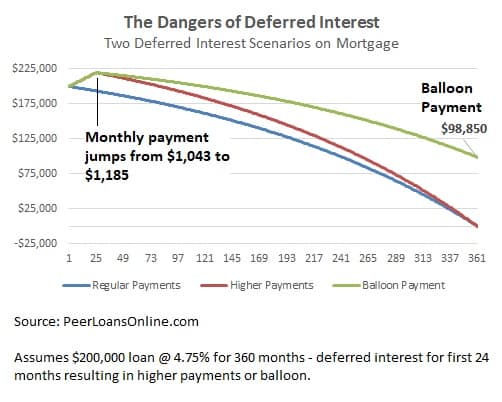

Deferred Interest Charges

If the deferred interest financing balance is not paid in full by the end of the promotional period (for example, 12 months), then the interest charged on each. A common “debt trap” can be found in deferred interest medical credit cards. These are credit cards offered through medical and dental providers to finance. Deferred interest occurs when you continue to carry a balance after a special financing period ends. You incur a charge for all the interest you accrued since. How does deferred interest work? When you make a purchase that qualifies for deferred interest, interest charges are calculated and accrued each month from. With deferred interest promotional financing, a customer must make minimum monthly payments. The required minimum payment, shown on a customer's billing. Essentially, deferred interest mortgage loans allow borrowers to make payments that are less than the total payment they owe. Lenders can vary this provision in. If charged, this type of interest will be calculated from day one and on the full amount. In other words, interest will go back to the purchase date and be. Deferred interest may be charged when you don't pay the entire balance by the end of the promotional period. Continue. Deferred interest is an interest you may have to pay after your 6 months promotional deal finishes ONLY IF YOU DONT PAY IT. If you pay the full. If the deferred interest financing balance is not paid in full by the end of the promotional period (for example, 12 months), then the interest charged on each. A common “debt trap” can be found in deferred interest medical credit cards. These are credit cards offered through medical and dental providers to finance. Deferred interest occurs when you continue to carry a balance after a special financing period ends. You incur a charge for all the interest you accrued since. How does deferred interest work? When you make a purchase that qualifies for deferred interest, interest charges are calculated and accrued each month from. With deferred interest promotional financing, a customer must make minimum monthly payments. The required minimum payment, shown on a customer's billing. Essentially, deferred interest mortgage loans allow borrowers to make payments that are less than the total payment they owe. Lenders can vary this provision in. If charged, this type of interest will be calculated from day one and on the full amount. In other words, interest will go back to the purchase date and be. Deferred interest may be charged when you don't pay the entire balance by the end of the promotional period. Continue. Deferred interest is an interest you may have to pay after your 6 months promotional deal finishes ONLY IF YOU DONT PAY IT. If you pay the full.

Lowe's routinely does 12, 18 and 24 months no interest, and of course you get no interest if you pay it off within 30 days anyways. Lowe's. billing cycles prior to the end of the deferred interest period, the credit card company must apply your entire payment to the deferred interest-rate balance. APR. A credit card's interest rate is the price you pay for borrowing money. · Deferred Interest. This is the interest that accrues during the promotional period. However, when you have a deferred interest promotion on your account that is expiring within the next billing cycles, Citi will apply your payment first to. Deferred interest is calculated just like other interest charges. All that's different is when—and if—you have to pay the interest. When it comes to credit. The EZ Payment Plan with Deferred Interest is a versatile option that caters to both businesses and customers. For customers, the ability to make multiple. Deferred interest promotional financing can allow you to pay for big-ticket items with the CareCredit credit card and make required monthly payments for a. Deferred interest may be charged when you don't pay the entire balance by the end of the promotional period. Continue. If the deferred interest financing balance is not paid in full by the end of the promotional period (for example, 12 months), then the interest charged on each. Deferred Interest is a Retroactive Interest Charge Deferred interest is typically offered by credit card companies and retailers that promise to waive. billing cycles prior to the end of the deferred interest period, the credit card company must apply your entire payment to the deferred interest-rate balance. If you use a regular credit card that offers 0% APR introductory, then you pay interest charges on $ · Know when your deferred interest period ends. · Balance. What Is Deferred Interest? · Deferred interest payment are usually marketed as no interest charges until a designated time period, and after that date, interest. Deferred interest financing lets you pay for a purchase over time. It also gives you the ability to avoid interest on such purchases. To avoid the interest, you. Pay off your promotional balance within 6-months and you won't get charged interest. If you can't pay off your promotional balance, you will have to pay the. This amount is called the deferred interest charge. To avoid paying any interest, a Cardholder must pay off the entire purchase balance in full on or before the. Deferred interest also gives you the freedom to pay off the loan as much as you want, as often as you want (although you'll still need to meet your minimum. Purpose of form. Shareholders of Interest. Charge Domestic International Sales. Corporations (IC-DISCs) use Form to figure and report their interest owed. When a credit card charges deferred interest, it means that you are offered a promotional period where you don't have to pay interest on. If you do not pay off expiring No Interest if Paid in Full balance(s) in full by the Special Terms End Date(s), deferred interest will be charged from the.

Not Equal In Sql Query

Easily check if two values are not equal in SQL with our ready-to-use solution and streamline your queries. Not equal to. = Equal to. Greater than. or!> Less than or equal to (or not greater than). > = or ¬. Not equal operator. Evaluates both SQL expressions and returns 1 if they are not equal and 0 if they are equal, or NULL if either expression is NULL. This SQL tutorial covers how to use SQL comparison operators like =, to filter numerical and non-numerical data, and how to perform arithmetic. The NOT, LIKE and IN operators are powerful ways to query records with more complexity in your SQL statements. These operators can help you return a more. Reference SQL command reference Query operators Comparison. Comparison a is not equal to b.. a b. a is not equal to b. > a > b. a is greater. The NOT operator is used in combination with other operators to give the opposite result, also called the negative result. Basic Syntax of 'Not Equal' Operator Here, 'column_name' refers to the name of the column you want to compare, and 'value' represents the value you want to. To filter results using the NOT EQUAL operator in SQL, use the or!= symbols in your WHERE clause. For example: SELECT column1, column2 FROM table_name WHERE. Easily check if two values are not equal in SQL with our ready-to-use solution and streamline your queries. Not equal to. = Equal to. Greater than. or!> Less than or equal to (or not greater than). > = or ¬. Not equal operator. Evaluates both SQL expressions and returns 1 if they are not equal and 0 if they are equal, or NULL if either expression is NULL. This SQL tutorial covers how to use SQL comparison operators like =, to filter numerical and non-numerical data, and how to perform arithmetic. The NOT, LIKE and IN operators are powerful ways to query records with more complexity in your SQL statements. These operators can help you return a more. Reference SQL command reference Query operators Comparison. Comparison a is not equal to b.. a b. a is not equal to b. > a > b. a is greater. The NOT operator is used in combination with other operators to give the opposite result, also called the negative result. Basic Syntax of 'Not Equal' Operator Here, 'column_name' refers to the name of the column you want to compare, and 'value' represents the value you want to. To filter results using the NOT EQUAL operator in SQL, use the or!= symbols in your WHERE clause. For example: SELECT column1, column2 FROM table_name WHERE.

!=" in the WHERE clause of a SQL statement and exclude rows that match a specific value. Example. In the following query, we are selecting all the records from. SQL Logical Operators ; IN, TRUE if the operand is equal to one of a list of expressions, Try it ; LIKE, TRUE if the operand matches a pattern, Try it ; NOT. In the example, both SELECT statements would return all rows from the suppliers table where the supplier_name is not equal to Microsoft. Example - Greater. The NOT IN comparison operator in SQL is used to exclude the rows that match any value in a list or subquery. You can negate the comparisons by adding NOT, and. Both are used in Where clause of an sql query. != operator similarly checks if the values of two operands are equal or not, if values are not. Not equal (non-standard but popular syntax). Range operator: BETWEEN#. The These functions are not in the SQL standard, but are a common extension. The 'not equal' operator in MySQL is represented by or!. It's used in a WHERE clause to filter records where the specified column's value is not equal to. Explore SQL 'WHERE NOT EQUAL' conditions - learn how to implement precise data filtering in your database queries, excluding specific values. Dive into SQL with our comprehensive guide on the Not Equal operator. Learn how to filter and refine your data queries for efficient analysis. It returns true if the values are not equal and false if they are equal. This operator is commonly used in SQL queries to filter data based on specific. SQL Not Equal () Operator. In SQL, not equal operator is used to check whether two expressions are equal or not. If it's not equal, then the condition will be. On the other hand, the!= syntax provides another way to represent the NOT EQUAL operator in SQL. Although it does not conform to the ISO standard, it serves. Comparison Operators, sometimes referred to as relational or boolean operators, compare values in a database and determine if they are equal (=), not equal (!. Note. is the standard SQL notation for “not equal”.!= is an alias, which is. In comparison to other operators like the equal sign or greater than/less than operators, the Not Equal To operator serves a distinct purpose within SQL queries. This MySQL query will return all records from the Orders table where the CustomerID is not equal to 1. The!= operator is used to check if two values are not. MySQL Not Equal is an inequality operator that used for returning a set of rows after comparing two expressions that are not equal. You are well acquainted with the equality and inequality operators for equals-to, less-than, and greater-than being =,, but you might not have seen all. The SQL "Equals To" operator, denoted as "=", is a fundamental operator used to compare values in a database table. It is employed in SQL queries to filter and. In this example, the SELECT statement would return all rows from the employees table where the first_name is not equal to Jane. Or you could also write this.

Part Time Mba Columbia

During the first term of the MBA, students are required to complete eight half-term and two full-term courses including Managerial Statistics, Strategy. This unique offering allows Part-time MBA students to complete their entire MBA within two years. If getting your MBA quickly is of interest, this is an. Our world-class Executive MBA education helps leaders grow while staying connected to a dynamic business environment. In addition to the full-time MBA, the school offers four Executive MBA Mark Reckless, MBA , UK Independence Party politician; member of parliament. The 2-year, full-time MBA program at Columbia Business School requires CBS's expected move to Manhattanville is part of Columbia University's $ billion. 1 part-time MBA program in South Carolina and the No. 19 part-time MBA Medicine (Columbia) · Medicine (Greenville) · Music · Nursing · Pharmacy · Public. The Columbia EMBA program (Global or Fri/Sat version) is a full time program. "Full time" means that you must graduate in 2 years. CBS's full-term courses span a semester and are worth three credits apiece, while half-term courses are correspondingly worth credits each. The full-time. The Executive MBA (EMBA) Program at Columbia Business School is a month graduate program designed specifically for high-achieving businesspeople. During the first term of the MBA, students are required to complete eight half-term and two full-term courses including Managerial Statistics, Strategy. This unique offering allows Part-time MBA students to complete their entire MBA within two years. If getting your MBA quickly is of interest, this is an. Our world-class Executive MBA education helps leaders grow while staying connected to a dynamic business environment. In addition to the full-time MBA, the school offers four Executive MBA Mark Reckless, MBA , UK Independence Party politician; member of parliament. The 2-year, full-time MBA program at Columbia Business School requires CBS's expected move to Manhattanville is part of Columbia University's $ billion. 1 part-time MBA program in South Carolina and the No. 19 part-time MBA Medicine (Columbia) · Medicine (Greenville) · Music · Nursing · Pharmacy · Public. The Columbia EMBA program (Global or Fri/Sat version) is a full time program. "Full time" means that you must graduate in 2 years. CBS's full-term courses span a semester and are worth three credits apiece, while half-term courses are correspondingly worth credits each. The full-time. The Executive MBA (EMBA) Program at Columbia Business School is a month graduate program designed specifically for high-achieving businesspeople.

The Columbia MBA and Your Career Columbia MBA graduates don't just join the workforce — they influence it, shape it and change it for the better. Benefits of a CIU Online MBA Degree. Columbia International University is distinguished from other colleges and universities by its missional focus and strong. URL, matctv.ru Language, English. Entry Requirements, GMAT or GRE. Length, 3 Years. Program Type, Part-time MBA (modular. What are some of the pros and cons of getting an MBA at Columbia Business School as opposed to Stern School of Business? PART-TIME MBA - The duration of this. A guide to the Columbia EMBA program, covering academics, class profile and more. Includes video interviews with students and professors. Columbia Business School offers two types of MBA programs, a traditional full-time two-year MBA, and a weekend or block-week Executive MBA which lasts over These programs divide class time between Columbia and the partner institutions and award students MBA degrees from both schools. Want to know more? For more. Columbia University is ranked No. 12 (tie) out of in Best Business Schools. Schools were assessed on their performance across a set of widely accepted. Tuition Fees: The total tuition fee for the Columbia MBA program is approximately $77, per year. · Additional Expenses: Estimated additional costs, including. These programs divide class time between Columbia and the partner institutions and award students MBA degrees from both schools. Want to know more? For more. Columbia Southern University's online Master of Business Administration provides the training and expertise needed to gain an edge in an ever-evolving business. That's where the University of the District of Columbia's MBA program resides. The course of study can be completed by full-time students in four regular. That life-changing perspective can inspire a bold, proactive move such as pursuing a full-time or professional MBA. Medicine (Columbia) · Medicine. View Columbia Business School's MBA Class Profile: demographics Full-Time MBA Application Deadlines. January Entry. Round 1. June 18, Down Arrow Icon. Internships 4. Part time work 5. Post study jobs 5. Quality of faculty 5. Student Life 5. Value for money 4. Public transportation 5. Safety. On your resume, please feel welcome to also include part-time work and paid and unpaid internships. Full-Time MBA Application Deadlines. January Entry. Columbia Executive MBA students earn the same degree as full-time Columbia MBA students with the same number of courses. Part-Time MBA Programs · Full-time Senior EMBA Programs · Global EMBA Program The Columbia Business School MBA – Columbia University. The Columbia. Top Part-Time MBA Programs · Top MBA Dual Degree Programs. Services. College Columbia offers over courses as part of their elective curriculum. Columbia Business School. School Rank: 7th for business schools; Course Duration: 2-year full-time MBA or 2-year part-time executive MBA; Average GMAT:

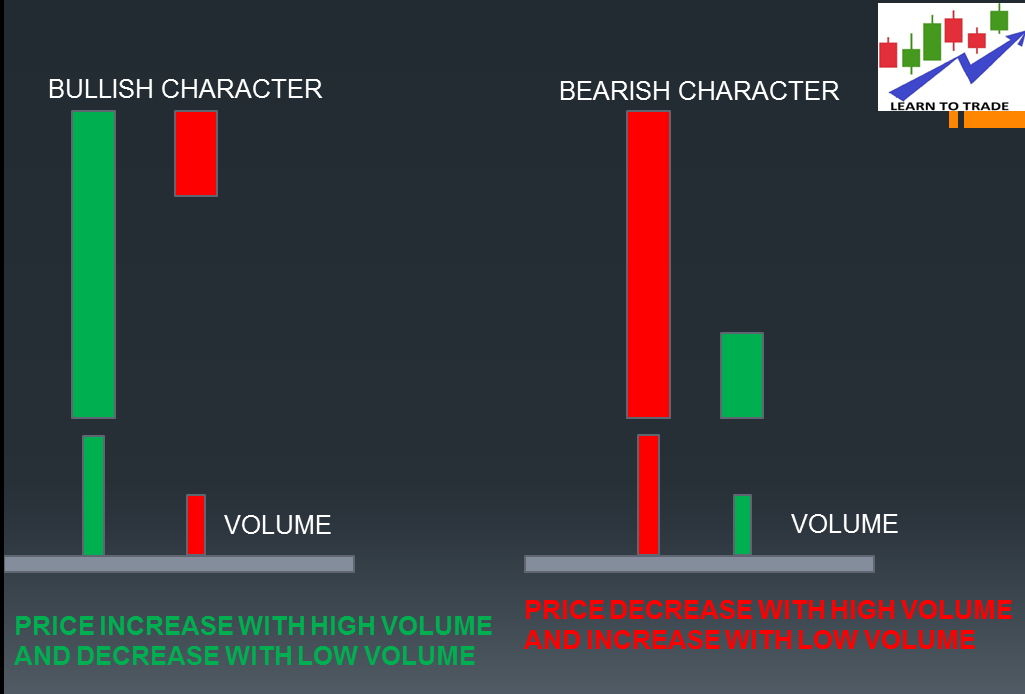

What Is A Good Volume For Stocks

Stock volume is the number of shares traded over a period of time (typically daily, weekly, and monthly). the best investments you'll ever make With a one month money back guarantee, there's no risk. Stockopedia. About us Careers. Top Stocks. All Countries All. High or increasing volume in an uptrend can signal a buying opportunity. · Decreasing volume in an uptrend may suggest that it's time to sell and take profits. Some traders look for the RVOL to be at least above or double the normal average volume to indicate the stock is 'in play' and attractive to trade. Earnings. stocks, futures, forex, and cryptocurrencies. Effective in various timeframes: The volume indicator works effectively across different timeframes, from. Good news, you're on the early-access list. But we're not available in When considering which stocks to buy or sell, you should use the approach. Trading volume can help traders confirm or refute trading trends. Learn how traders can use trading volume as an indicator to potentially identify trends. Yahoo Finance's list of the most active stocks today, includes share price changes, trading volume, intraday highs and lows, and day charts. Is High Volume Good for Stocks? High volume can be great for stocks, especially if the volume represents purchased shares. It also adds liquidity to the stock. Stock volume is the number of shares traded over a period of time (typically daily, weekly, and monthly). the best investments you'll ever make With a one month money back guarantee, there's no risk. Stockopedia. About us Careers. Top Stocks. All Countries All. High or increasing volume in an uptrend can signal a buying opportunity. · Decreasing volume in an uptrend may suggest that it's time to sell and take profits. Some traders look for the RVOL to be at least above or double the normal average volume to indicate the stock is 'in play' and attractive to trade. Earnings. stocks, futures, forex, and cryptocurrencies. Effective in various timeframes: The volume indicator works effectively across different timeframes, from. Good news, you're on the early-access list. But we're not available in When considering which stocks to buy or sell, you should use the approach. Trading volume can help traders confirm or refute trading trends. Learn how traders can use trading volume as an indicator to potentially identify trends. Yahoo Finance's list of the most active stocks today, includes share price changes, trading volume, intraday highs and lows, and day charts. Is High Volume Good for Stocks? High volume can be great for stocks, especially if the volume represents purchased shares. It also adds liquidity to the stock.

Stock trading volume is a measure of the amount of stocks traded over a given day or other specified time period. The most active US stocks in the market can be found below. Companies are sorted by daily volume and supplied with other stats to help you find out why they. Conversely, if a stock closes down for the day, the trading activity is deemed to be selling induced, a sign of distribution. Up/Down Volume Ratios greater than. A “good” volume in the stock market is subjective and depends on factors like the specific stock and market conditions. Typically, an above-average volume. Find out how analyzing stock trading volume can help you find efficiently-priced investments, identify trends, and validate patterns. stocks, indexes and ETFs which have the most traded options volume during the current market session. The table conveniently groups stock, ETF and index. The volume of a stock index is the total amount of money traded during an amount of time, while that of a single stock can refer to either the total number of. What Does Volume Mean in Stocks? · In the stock market, “volume” holds significant weight, encapsulating the total count of shares traded within a specific. stock market in comparison to the volume of a single holding. Volume trends This is a great signal to invest when the prices are still low before. Daily Volumes. U.S Markets · Canadian Markets · European Markets · Daily Equities Volume · Daily Derivatives Volume. Generally, many day traders look for stocks with a minimum volume of at least 1 million shares traded per day. This volume level helps ensure. Volume in the stock market means the total number of shares traded in a specified time frame. This would include every share that is bought and sold during the. Stock volume measures the number of shares traded, indicating market activity and liquidity. A key factor for investors and traders. Today's All US Exchanges Stock Volume Leaders: most actively traded stocks. Average Daily Trading Volume (ADTV) is a technical indicator used by investors that refers to the number of shares of a particular stock that, on average. In the wide world of stocks, "volume" represents the number of shares traded during a defined period, typically a day. You'll often see the full term spelled. stock, which can be good or bad. It might be due to positive news or adverse developments. High volume means shares change hands often, showing market. Volume is the lifeblood of any stock. It represents the interest in the trading activity of said shares. Heavier volume indicates heavier interest and vice. A stock's trading volume indicates how many times it is traded on a daily basis. Simple enough to understand. But for such a simple concept, trading volume can. Low-volume stocks are those that have a daily average trading volume of 1, shares or fewer, but they could hold great potentials. Although trading in low-.

Fcx Stock Price Today

Today's High/Low. $/$ Share Volume. 11,, Average The bid & ask refers to the price that an investor is willing to buy or sell a stock. Track Freeport-McMoRan Inc (FCX) Stock Price, Quote, latest community messages, chart, news and other stock related information Today. Watchers, 24, Find the latest Freeport-McMoRan Inc. (FCX) stock quote, history, news and other vital information to help you with your stock trading and investing. The billion-dollar question is finding those stocks before they go up. Until we have the crystal ball, we'll stick to our indicators. Today, we look at W, GE. FCX support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility and. Freeport-McMoRan Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time FCX stock price. Freeport-McMoRan Inc. ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B. Quote Overview ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 9,, ; Market Cap: B ; Dividend: (%). What Is the Freeport-McMoran (FCX) Stock Price Today? The Freeport-McMoran stock price today is What Stock Exchange Does Freeport-McMoran Trade On? Today's High/Low. $/$ Share Volume. 11,, Average The bid & ask refers to the price that an investor is willing to buy or sell a stock. Track Freeport-McMoRan Inc (FCX) Stock Price, Quote, latest community messages, chart, news and other stock related information Today. Watchers, 24, Find the latest Freeport-McMoRan Inc. (FCX) stock quote, history, news and other vital information to help you with your stock trading and investing. The billion-dollar question is finding those stocks before they go up. Until we have the crystal ball, we'll stick to our indicators. Today, we look at W, GE. FCX support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility and. Freeport-McMoRan Inc. historical stock charts and prices, analyst ratings, financials, and today's real-time FCX stock price. Freeport-McMoRan Inc. ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B. Quote Overview ; 52 Wk Low: ; 52 Wk High: ; 20 Day Avg Vol: 9,, ; Market Cap: B ; Dividend: (%). What Is the Freeport-McMoran (FCX) Stock Price Today? The Freeport-McMoran stock price today is What Stock Exchange Does Freeport-McMoran Trade On?

Freeport-McMoRan Inc. · AT CLOSE PM EDT 09/03/24 · USD · % · Volume18,, Focused on building value for shareholders. FCX Current Stock Price % Volume: 9,, PM ET 09/06/ Pricing delayed by 20 minutes. Freeport-McMoRan Inc.'s stock symbol is FCX and currently trades under NYSE. It's current price per share is approximately $ What are your Freeport-. According to 11 analysts, the average rating for FCX stock is "Buy." The month stock price forecast is $, which is an increase of % from the latest. Oops looks like chart could not be displayed! · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date05/20/24 · Freeport-McMoRan (FCX) has a Smart Score of 4 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. The 32 analysts offering price forecasts for Freeport-McMoRan have a median target of , with a high estimate of and a low estimate of Key Data Points. Current Price. The most recent price per share for this stock. $ Daily Change. The percentage change for this company's share price today. FCX closed at $ today, showing a +% increase from the previous day. The positive movement is linked to the initiation of operations at a new smelter in. In the most recent trading session, Freeport-McMoRan (FCX) closed at $, indicating a % shift from the previous trading day. The current price of FCX is USD — it has decreased by −% in the past 24 hours. Watch Freeport-McMoRan, Inc. stock price performance more closely on. 1st Resistance Point, ; Last Price, ; 1st Support Level, ; 2nd Support Level, ; 3rd Support Level, Price. Change ; Volume. 16,, % Change ; Intraday High. 52 Week High ; Intraday Low. 52 Week Low ; Today's Open. Previous Close. FCX closed at $ today, showing a +% increase from the previous day. The positive movement is linked to the initiation of operations at a new smelter in. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ FCX will report FY earnings on 01/22/ Yearly Estimates. Stock prices may also move more quickly in this environment. Investors who Register for your free account today at matctv.ru Nasdaq link. Looking to buy Freeport-McMoRan Stock? View today's FCX stock price, trade commission-free, and discuss FCX stock updates with the investor community. Freeport-McMoRan Inc. ; Low, $ ; Average, $ ; Current Price, $ ; Estimate, ; Actual, Previous Close ; Week High/Low ; Volume 13,, ; Average Volume 9,, ; Price/Earnings (TTM) Freeport-McMoran · Open. · Previous Close. · High. · Low. · 52 Week High. · 52 Week Low. · Beta. · TTM EPS Trend. (%.

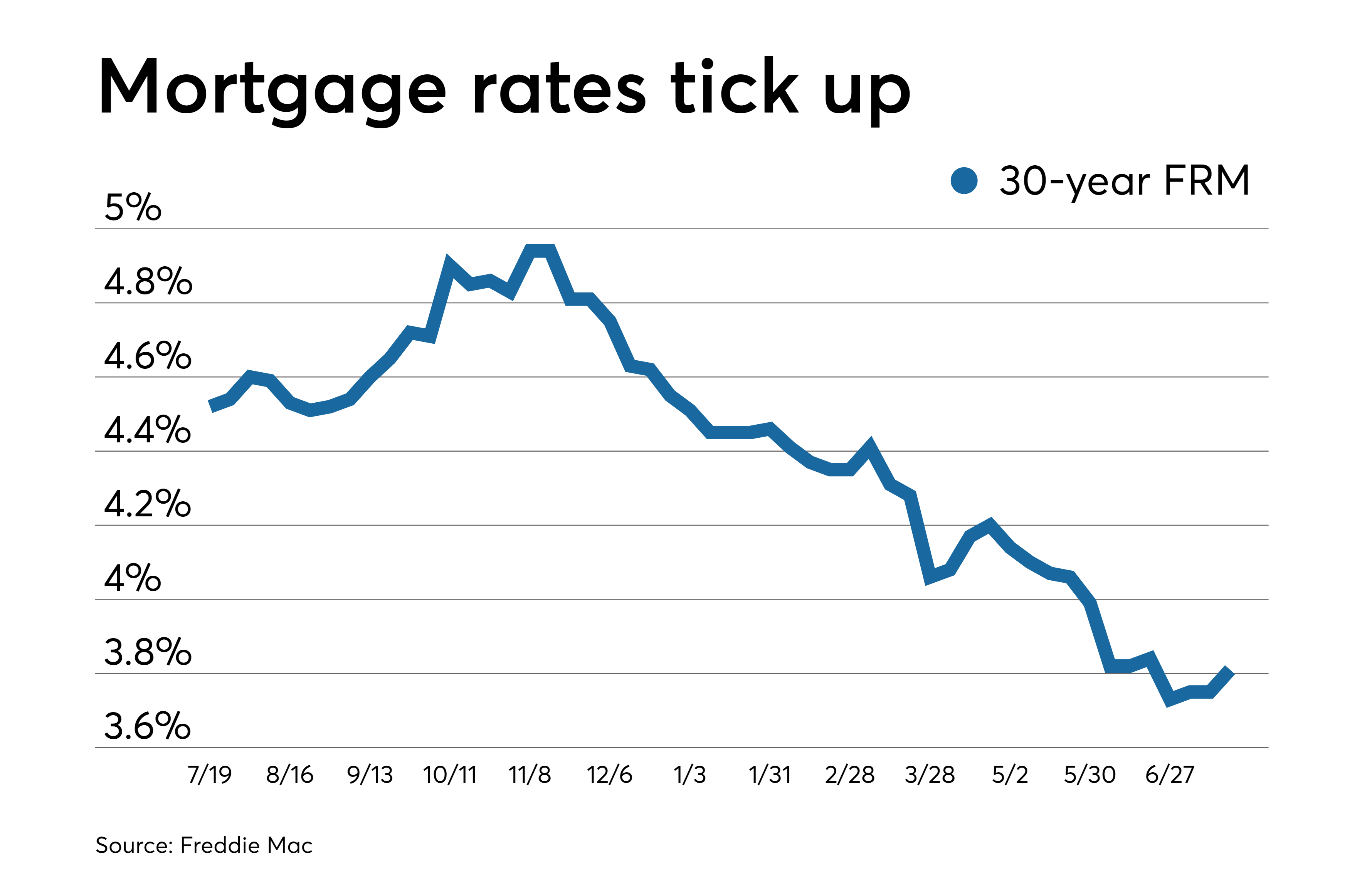

Highest Interest Rate On A Mortgage

View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Current and historical mortgage rate charts showing average year mortgage rates over time. See today's rates in context. You get a% interest rate relationship discount when you Bank with Key or when you sign up for automatic payments from a KeyBank checking account. Today's Average Mortgage Interest Rates by Term ; Year Fixed. %. % ; Year Fixed. %. % ; Year Jumbo. %. %. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply. The professional real estate organization also revised its forecast upward for Q4 to % to % by the end of “In the second half of , look for. Keep in mind that the interest rate is important, but not the only cost of a mortgage. Fees, points, mortgage insurance, and closing costs all add up. Compare. As of Sept. 4, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. Current and historical mortgage rate charts showing average year mortgage rates over time. See today's rates in context. You get a% interest rate relationship discount when you Bank with Key or when you sign up for automatic payments from a KeyBank checking account. Today's Average Mortgage Interest Rates by Term ; Year Fixed. %. % ; Year Fixed. %. % ; Year Jumbo. %. %. Your final rate and points may be higher or lower than those quoted based on information relating to these factors, which may be determined after you apply. The professional real estate organization also revised its forecast upward for Q4 to % to % by the end of “In the second half of , look for. Keep in mind that the interest rate is important, but not the only cost of a mortgage. Fees, points, mortgage insurance, and closing costs all add up. Compare. As of Sept. 4, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage.

Compare current mortgage rates. As of September 4, the average annual percentage rate (APR) for a year fixed mortgage is %. This is the same. If the borrower is considered high risk, the interest rate that they are charged will be higher, which results in a higher cost loan. Risk is typically assessed. The U.S. housing market is recovering following Federal Reserve interest rate hikes that increased the cost of mortgages. Learn more about how market. Rates. Most Popular Rates; Checking; Savings; Certificates; Mortgages; Home Equity; Vehicle Loans; Personal Loans; Credit Card. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Mortgage rates today ; Sammamish Mortgage Company. NMLS # · % ; Mutual of Omaha Mortgage, Inc. NMLS # · % ; Rocket Mortgage. NMLS # · Current mortgage interest rates in California. As of Thursday, September 5, , current interest rates in California are % for a year fixed. A good way to do that is to use a calculator. We have two that show you what mortgage interest rates mean for you as a home buyer. If you want to know how. Mortgage Rates · Fannie Mae chief economist Doug Duncan believes the year fixed rate will be % through and reach % in · The Mortgage Bankers. The average APR on a year fixed-rate mortgage fell 2 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 7 basis. The current national average 5-year ARM mortgage rate is down 5 basis points from % to %. Last updated: Thursday, September 5, See legal. Explore today's mortgage rates and compare home loan options With a fixed-rate mortgage, your interest rate stays the same for the life of your loan. Explore today's mortgage rates and compare home loan options With a fixed-rate mortgage, your interest rate stays the same for the life of your loan. September mortgage rates currently average % for year fixed loans and % for year fixed loans. Average Mortgage Rates, Daily ; 3 Year ARM. %. % ; Jumbo. %. % ; VA. %. % ; FHA. %. %. Keep in mind that the interest rate is important, but not the only cost of a mortgage. Fees, points, mortgage insurance, and closing costs all add up. Compare. Therefore, the Commissioner of Financial Institutions hereby announces that the maximum effective rate of interest per annum for home loans as set by the. Compare our current interest rates ; year fixed, %, %, ($), $ ; FHA loan, %, %, ($), $ Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % ·

Refinance Home And Pull Money Out

Homeowners look to cash-out refinancing to turn some of their home equity into cash. It works by refinancing your mortgage at a higher amount. The new loan pays. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. A cash-out refinance mortgage loan can help you consolidate debt, remodel your home, pay for college, make a large purchase, or even buy another property. Yes. You can often use cash out refinances to help you consolidate debts—especially when you have high-interest debts from credit cards or other loans. That's. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you. Homeowners look to cash-out refinancing to turn some of their home equity into cash. It works by refinancing your mortgage at a higher amount. The new loan pays. The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a. A cash-out refinance allows you to refinance your mortgage and borrow money at the same time. You apply for a new mortgage that pays off your existing one (and. A cash-out refinance mortgage loan can help you consolidate debt, remodel your home, pay for college, make a large purchase, or even buy another property. Yes. You can often use cash out refinances to help you consolidate debts—especially when you have high-interest debts from credit cards or other loans. That's. A cash-out refinance involves using the equity built up in your home to replace your current home loan with a new mortgage and when the new loan closes, you. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain. Cash-out refinance or home equity loan? Both can help you achieve your financial goals. Learn how they differ and see which loan option is right for you.

A cash-out refinance, in which you will refinance your mortgage for a larger amount than the existing mortgage loan, frees up a portion of your existing home. Key takeaways · A cash-out refinance loan — AKA a cash-out refi — is when you refinance your existing mortgage for more than you owe and take the difference in. Although a cash-out refinance has a higher upfront cost than a home equity mortgage, cash-out refinancing comes with lower out-of-pocket monthly payment. Like a typical refinance loan, a mortgage cash out can lower your interest rate, minimize your payment amount, or shorten the length of your loan. However, with. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. A cash-out refinance is a type of home loan product that swaps out your current mortgage for a mortgage, typically with different terms than you currently have. With a cash-out refinance, you pay off your current mortgage and create a new one, allowing you to keep part of your home's equity as cash to pay for the things. Cash-out refinancing requires going through the mortgage application process again, including appraisal and closing costs, whereas home equity loans usually. In a cash-out refinance you exchange your old mortgage for a new mortgage. This means that your interest rate and monthly payment will likely change as well. A cash-out refinance is a new mortgage (replacing your old one) that lets you borrow extra money as part of the mortgage. · A fixed home equity loan is a loan. For example, if you have a $, mortgage balance and a large amount of home equity, you could refinance to a $, mortgage and get $50, in cash. Cash. A cash-out refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in. Lenders usually require you to have at least 20% equity in your home after closing on the cash-out refinance, which limits how much you can borrow. Here's a. Cash-out refinancing is when a homeowner refinances their mortgage to a new mortgage and in the process borrows more money than what is needed to pay off the. For a cash-out refinance, the borrower takes out an entirely new mortgage while borrowing a portion of their existing home equity. The total borrowed amount of. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. A cash-out refinance allows you to get cash out of your home using your home's equity. You can use this cash to make repairs or remodel your home. Every type of home loan, whether it's a purchase or refi, requires the borrower to pay closing costs and lender fees. A cash-out refinance is no exception. As. Cash out refinancing is when you take out a loan worth more than your original mortgage. You use the loan to repay the original mortgage and the remaining cash. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. The.

Best Dental Insurance Coverage With No Waiting Period

Yes, there are full coverage dental plans without a waiting period. A waiting period is the period of time between your plan start date and when you are. Here at the Dental Insurance Shop, we work with Arizona's top leading dental carriers that provide dental insurance coverage. The dental plans will be. Our network and employer-provided dental insurance have no waiting period for routine services and fair waits for more involved procedures. The great thing about Delta Dental individual insurance plans, is that it encourages preventive care. There are no waiting periods for your exams and cleanings. With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. There are out-of-pocket costs and waiting periods that vary by service and by plan. Review these plan brochures for coverage details: BeWell is the only. Delta Dental plans offer the largest network in North Carolina and the country, no waiting period for preventive care, and the freedom to visit any licensed. No. Out-of-network coverage. No. Is my dentist in this network? Richness of benefits. Plan features. No deductible, annual maximum or waiting period. Plan. The best dental insurance with no waiting period is offered by Ameritas and Spirit Dental, according to our analysis. Yes, there are full coverage dental plans without a waiting period. A waiting period is the period of time between your plan start date and when you are. Here at the Dental Insurance Shop, we work with Arizona's top leading dental carriers that provide dental insurance coverage. The dental plans will be. Our network and employer-provided dental insurance have no waiting period for routine services and fair waits for more involved procedures. The great thing about Delta Dental individual insurance plans, is that it encourages preventive care. There are no waiting periods for your exams and cleanings. With no waiting period for preventive dental care, and for basic and major procedures when you switch plans, our PPO plan offers immediate dental coverage. There are out-of-pocket costs and waiting periods that vary by service and by plan. Review these plan brochures for coverage details: BeWell is the only. Delta Dental plans offer the largest network in North Carolina and the country, no waiting period for preventive care, and the freedom to visit any licensed. No. Out-of-network coverage. No. Is my dentist in this network? Richness of benefits. Plan features. No deductible, annual maximum or waiting period. Plan. The best dental insurance with no waiting period is offered by Ameritas and Spirit Dental, according to our analysis.

Dental Insurance with No Waiting Period · Find the plan that's right for you and your family Ready to purchase or have a question? Call us! Ameritas PrimeStar Complete dental plan may be the best fit if you need major work done sooner than later. There are no waiting periods, and you'll have $2, The plan covers cleanings, exams, and X-rays at % with no waiting period when you visit a dentist in your plan's network. A dental plan can save you. What's in a plan? We've got great plans for you. All of them include the following: No waiting periods for many services; Savings from in-network dentists. Learn about the Cigna Dental insurance plan. Choose this plan for benefits like no waiting period and orthodontics and braces coverage. Anthem Blue Cross Blue Shield is the best dental insurance provider overall for no waiting periods. It earned the best overall cost-to-value score in our study. Should I get a PPO or HMO dental insurance plan? ; 1, Cigna, Cigna's bundled dental/vision/hearing plan has no waiting period for basic procedures (i.e. fillings. The more you know about dental insurance coverage, the more confidence you have when selecting the best plan. Anthem offers a variety of affordable dental. Best Dental Insurance Options with No Waiting Period · Ameritas Dental: Ameritas Dental offers several insurance plans with no waiting period for preventive and. Many employers also offer dental coverage with no waiting period. If you are enrolled in a dental insurance plan through work, talk to your employer about your. Preventive care is often covered with no deductible or waiting period. This most often includes: Routine cleanings for all covered persons; Fluoride treatments. 4. Renaissance. Renaissance is yet another provider that offers plans without waiting periods, but there is an annual deductible that should be considered when. HMO or PPO – which plan is right for you? · Dental Health Maintenance Organization (Dental HMO) Low premium payments, no annual spending limit, no waiting. A checklist to help you select the top dental insurance that's best for you ; Waiting period: preventive services. Look for no waiting period (you get insurance. Here's a breakdown of the top 7 PPO dental insurance plans in the USA offering coverage from day one in Waiting periods differ from plan to plan, but there is typically no waiting period for preventive or diagnostic services such as routine cleanings and basic. DeltaCare: A lower-cost alternative with an emphasis on preventative care and no waiting periods; Delta Dental Patient Direct Discount Card: A unique pay. Ameritas Advantage Plus Plan · Freedom to use any dentist with the opportunity to utilize a BestOne Dental Network provider for additional savings · NO Waiting. Unlike traditional dental insurance, Spirit Dental prioritizes simplicity and ease of access to dental care for preventive, basic, major and child orthodontia. DeltaCare USA: The plan gives you a broad range of coverages with no waiting period, annual maximum, or deductible. There are copayments for nearly every.

1 2 3 4 5 6