matctv.ru

Gainers & Losers

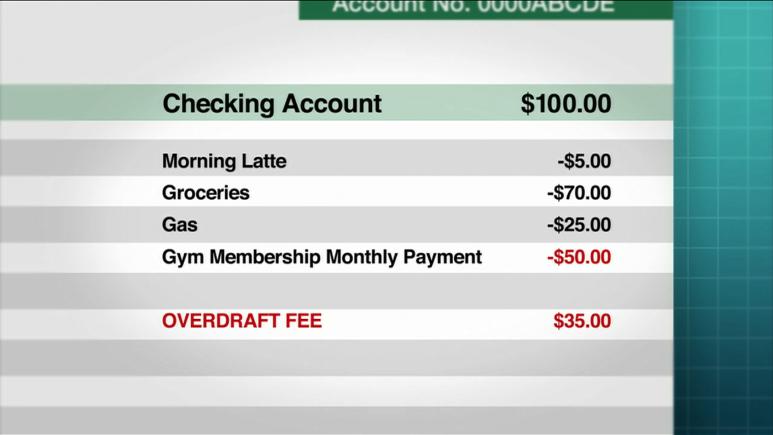

Fight Overdraft Fees

If you bring your available balance to at least $0, we will not assess any Overdraft Fees. If you do not use Extra Time to make a deposit, or if your deposit is. Our legislation would go further, however, and limit the number of overdraft fees that banks can charge to one per month and to no more than six per year, and. Fighting overdraft fees requires proactive communication with your bank. Start by reaching out to them, explaining the circumstances that led to the overdraft. Excessive overdraft fees charged by banks and credit unions can cause devastation for financially vulnerable families. Many lenders used predatory policies. Call your bank. Contact your bank as soon as you realize you've been charged an overdraft fee. · Explain what happened. · Provide a timeline. · Point out your. Extra Time – you'll have at least 24 hours to bring your available Spend account balance to at least $0 before you are charged overdraft fees. Payment Control –. Depending on the circumstances and your banking relationship you might consider settling for a refund of half of the fees. If the bank paid. An overdraft fee occurs when you try to spend more money than you have available in your checking account. Link your checking account to an overdraft line of credit, savings account, or credit card. These are usually less expensive alternatives, but remember that for. If you bring your available balance to at least $0, we will not assess any Overdraft Fees. If you do not use Extra Time to make a deposit, or if your deposit is. Our legislation would go further, however, and limit the number of overdraft fees that banks can charge to one per month and to no more than six per year, and. Fighting overdraft fees requires proactive communication with your bank. Start by reaching out to them, explaining the circumstances that led to the overdraft. Excessive overdraft fees charged by banks and credit unions can cause devastation for financially vulnerable families. Many lenders used predatory policies. Call your bank. Contact your bank as soon as you realize you've been charged an overdraft fee. · Explain what happened. · Provide a timeline. · Point out your. Extra Time – you'll have at least 24 hours to bring your available Spend account balance to at least $0 before you are charged overdraft fees. Payment Control –. Depending on the circumstances and your banking relationship you might consider settling for a refund of half of the fees. If the bank paid. An overdraft fee occurs when you try to spend more money than you have available in your checking account. Link your checking account to an overdraft line of credit, savings account, or credit card. These are usually less expensive alternatives, but remember that for.

Before opting-in, consumers receive a one-page, consumer-tested, government required, opt-in form that explains debit card overdrafts and less expensive. You can avoid this fee by promptly covering your overdraft – deposit or transfer enough available funds to cover your overdraft, plus any fees we assessed. We will not charge you a Returned Item Fee for items presented against insufficient funds in your account and returned unpaid. Overdraft service applies to. All you need to do is call your bank and ask nicely if they'll reverse the overdraft fee as a courtesy. Overdraft fees can still apply even if you remove standard overdraft coverage; however, we do not assess fees for returned items or declined transactions. Help. Worried about negative bank accounts? With TD Overdraft Relief, no overdraft fee will be charged for $50 or less overdraws. Learn more now! Standard Overdraft Practices. When an overdraft happens, our standard practice is to try to honor (or pay) the item rather than returning it unpaid. That night, we pay a check you've written for $80, leaving your account overdrawn by $60 and subject to a $35 overdraft fee. On Friday, we receive your deposit. We will charge you a fee of up to $35 each time we pay an overdraft up to a maximum of five fees per day. · If your account is overdrawn by less than $5, we will. If your account balance at the end of the business day is overdrawn by more than $50, then you need to make a deposit or transfer to avoid an Overdraft Fee on. You don't need to cover the overdraft fee in your deposit amount — only the transactions that caused your overdraft, plus any new transactions that process the. Some banks also offer an overdraft line of credit, which you may be able to borrow from, but later you'll have to pay the overdrawn amount plus interest. Now. At the end of the business day, we process your transactions. If your account is overdrawn by $50 or less, we won't charge an overdraft fee. And we won't charge. We will not charge you a Returned Item Fee for items presented against insufficient funds in your account and returned unpaid. Overdraft service applies to. The Paid Overdraft Item fee is $36 per item and is subject to change. There is no charge to your checking, savings or money market account. However, most banking institutions cap their charges between overdraft fees per day (though some banks may charge as many as 12 fees to a person's account. Overdraft fees can involve check, ACH or debit card transactions. Some banks will occasionally forgive an overdraft fee to help you cover other essential. The Paid Overdraft Item fee is $36 per item and is subject to change. There is no charge to your checking, savings or money market account. Refunds for overdraft fees are considered on a case-by-case basis. To speak with a credit union representative about your particular situation. You could qualify to join some of our clients who have already taken action against their Maryland banks for fraudulent overdraft fees and other improper.

Best Place To Put Money Today

Vanguard, Fidelity and Schwab each offer a good selection of their own index mutual funds - mostly with low expense ratios. You can purchase. One situation where extra cash may make more sense is if you're planning on a big purchase or expense within the next few years, such as buying a home, paying. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Where Should I Retire? Best Places · How to Invest · Virtual Stock Exchange Where Should I Retire? Top 25 ETFs · MarketWatch Picks · Money · Guides · Loans. Best short-term investments · High-yield savings accounts · CDs · Money market accounts · Government bonds · Treasury bills. (But if you cash before 5 years, you lose 3 months of interest.) More about EE bonds. (Note: Older EE bonds may be different from ones we sell today.) I. I don't know where to invest so I'm just hoarding cash I have never been in the stock markets and right now doesn't seem a good time to start. Interest-bearing accounts, including money market accounts or certificates of deposit (CDs), can be a good option for short-term saving. You can also assess. You've probably heard that cash is king right now. But where. Vanguard, Fidelity and Schwab each offer a good selection of their own index mutual funds - mostly with low expense ratios. You can purchase. One situation where extra cash may make more sense is if you're planning on a big purchase or expense within the next few years, such as buying a home, paying. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Where Should I Retire? Best Places · How to Invest · Virtual Stock Exchange Where Should I Retire? Top 25 ETFs · MarketWatch Picks · Money · Guides · Loans. Best short-term investments · High-yield savings accounts · CDs · Money market accounts · Government bonds · Treasury bills. (But if you cash before 5 years, you lose 3 months of interest.) More about EE bonds. (Note: Older EE bonds may be different from ones we sell today.) I. I don't know where to invest so I'm just hoarding cash I have never been in the stock markets and right now doesn't seem a good time to start. Interest-bearing accounts, including money market accounts or certificates of deposit (CDs), can be a good option for short-term saving. You can also assess. You've probably heard that cash is king right now. But where.

It offers a high % APY. It also has no minimum opening deposit and no monthly service fee. If you're interested in banking with an environmentally friendly. For a current list of the network of FDIC-insured banks where Cash Interest You could lose money by investing in the Fund. Although the Fund seeks. Round-Ups® investments are transferred from your linked funding source (checking account) to your Acorns Invest account, where the funds are invested into a. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Here's where experts recommend you should put your money during an inflation surge · 1. TIPS · 2. Cash · 3. Short-term bonds · 4. Stocks · 5. Real estate · 6. Gold · 7. During a bull market? Right now is the perfect time to start, unless you'll be needing that money within 5 or so years. The interest-bearing Platinum Savings account gives you several easy ways to get to your money Current Deposit Rates for 08/17/ - 08/23/ Annual. Wealthfront is designed to build wealth over time. Earn % APY on your uninvested cash, invest in a ladder of US Treasuries, and diversify for the long. Savings accounts are a good place to keep your cash safe and secure – even if interest rates aren't particularly high. The longer you can lock your money away. While they promise high returns, those who invest usually end up losing their money. And remember, if it sounds too good to be true, it probably is. How to buy. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. Whether you're saving. He says those rates indicate that it's a good time to open a high-yield savings account, which is a place to salt away money that you may need immediately. place. Open an account Invest your way. Schwab offers competitive yields on money market funds. Explore yields now. You deserve more. We can help. Transparent. Quontic began as a community bank in New York City in and is now a However, it isn't always the best place to put your money. There are other. However, in order for us to invest your money according to the investment Investopedia, February Fidelity was named Best Overall online broker, Best. These funds offer a low level of risk because they invest in low-risk investments like government-backed securities. You can use a money market fund to save for. Cowrywise helps Nigerians save and invest money regularly. We are re-imagining and reworking how financial services get delivered to people. Betterment can help grow your money by making saving and investing easy. Invest in a tailored portfolio, set buckets for your goals, and earn rewards. money market mutual funds (money market funds) and bank deposit solutions designed to provide liquidity, relative safety, and yields for your cash holdings. place. Open an account Invest your way. Schwab offers competitive yields on money market funds. Explore yields now. You deserve more. We can help. Transparent.

Bond Price Vs Yield

Rising interest rates affect bond prices because they often raise yields. In turn, rising yields can trigger a short-term drop in the value of your existing. The yield referred to in the above calculators is the current yield, which assesses the bond's coupon interest in relation to its current market price, rather. Price and yield are inversely related: As the price of a bond goes up, its yield goes down, and vice versa. There are several definitions that are important to. Coupon Rate vs. Yield-to-Maturity The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is. Bond prices have an inverse relationship with interest rates. This means that when interest rates go up, bond prices go down and when interest rates go down. Interest rates. Selected bond yields. View or download the latest data for bond yields, marketable bond average yields and selected benchmark bond yields. You. The yield and bond price have an important but inverse relationship. When the bond price is lower than the face value, the bond yield is higher than the coupon. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates. The price depends on the yield to maturity and the interest rate. If the yield to maturity is, the price of the bond or note will be. greater than the interest. Rising interest rates affect bond prices because they often raise yields. In turn, rising yields can trigger a short-term drop in the value of your existing. The yield referred to in the above calculators is the current yield, which assesses the bond's coupon interest in relation to its current market price, rather. Price and yield are inversely related: As the price of a bond goes up, its yield goes down, and vice versa. There are several definitions that are important to. Coupon Rate vs. Yield-to-Maturity The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is. Bond prices have an inverse relationship with interest rates. This means that when interest rates go up, bond prices go down and when interest rates go down. Interest rates. Selected bond yields. View or download the latest data for bond yields, marketable bond average yields and selected benchmark bond yields. You. The yield and bond price have an important but inverse relationship. When the bond price is lower than the face value, the bond yield is higher than the coupon. Get updated data about global government bonds. Find information on government bonds yields, bond spreads, and interest rates. The price depends on the yield to maturity and the interest rate. If the yield to maturity is, the price of the bond or note will be. greater than the interest.

To calculate the current yield, the formula consists of dividing the annual coupon payment by the current market price. Current Yield (%) = Annual Coupon ÷ Bond. Obviously, a bond must have a price at which it can be bought and sold (see “Understanding bond market prices” below for more), and a bond's yield is the actual. Medium- or intermediate-term bonds are generally those that mature in four to 10 years, and long-term bonds are those with maturities greater than 10 years. Not. Graph and download economic data for Interest Rates: Long-Term Government Bond Yields: Year: Main (Including Benchmark) for United States. A bond's yield is the return an investor expects to receive each year over its term to maturity. For the investor who has purchased the bond, the bond yield is. If the bond price is greater than the face value, the interest rate is greater than YTM. If the bond price is less than the face value, the interest rate is. Because bonds with longer maturities have a greater level of risk due to changes in interest rates, they generally offer higher yields so they're more. If interest rates were to fall, the value of a bond with a longer duration would rise more than a bond with a shorter duration. Therefore, in our example above. Note: The three-month Chinabond government bond yield is used by the International Monetary Fund as the RMB-denominated interest rate for the purpose of. When the line dips below zero, interest rates on longer-term bonds are lower than shorter-term bonds, i.e. an 'inverted' yield curve. Notice that every time. A bond's yield is influenced by the current market climate, meaning how much investors can demand for lending money to an issuer for a specified period of time. bonds operate and their terminology, please see our Investor Bulletin on Corporate Bonds. The Effect of Market Interest Rates on Bond Prices and Yield. A. Bonds market data, news, and the latest trading info on US treasuries and government bond markets from around the world. Bond yield refers to the rate of return or interest paid to the bondholder Now, bond prices and bond yields are inversely correlated. When bond prices. To calculate the current yield, the formula consists of dividing the annual coupon payment by the current market price. Current Yield (%) = Annual Coupon ÷ Bond. 2) Current Yield: Bonds fluctuate in price as interest rates change, and the current yield is calculated as the annual interest payment divided by the bond's. The rate is fixed at auction. It does not vary over the life of the bond. It is never less than %. See Interest rates of recent bond auctions. Various related yield-measures are then calculated for the given price. Where the market price of bond is less than its par value, the bond is selling at a. Yield is a figure that shows the return you get on a bond. The simplest version of yield is calculated by the following formula: yield = coupon amount/price. Concept Relationships among a Bond's Price, Coupon Rate, Maturity, and Market Discount Rate (Yield-to-Maturity) · A bond's price moves inversely with its YTM.

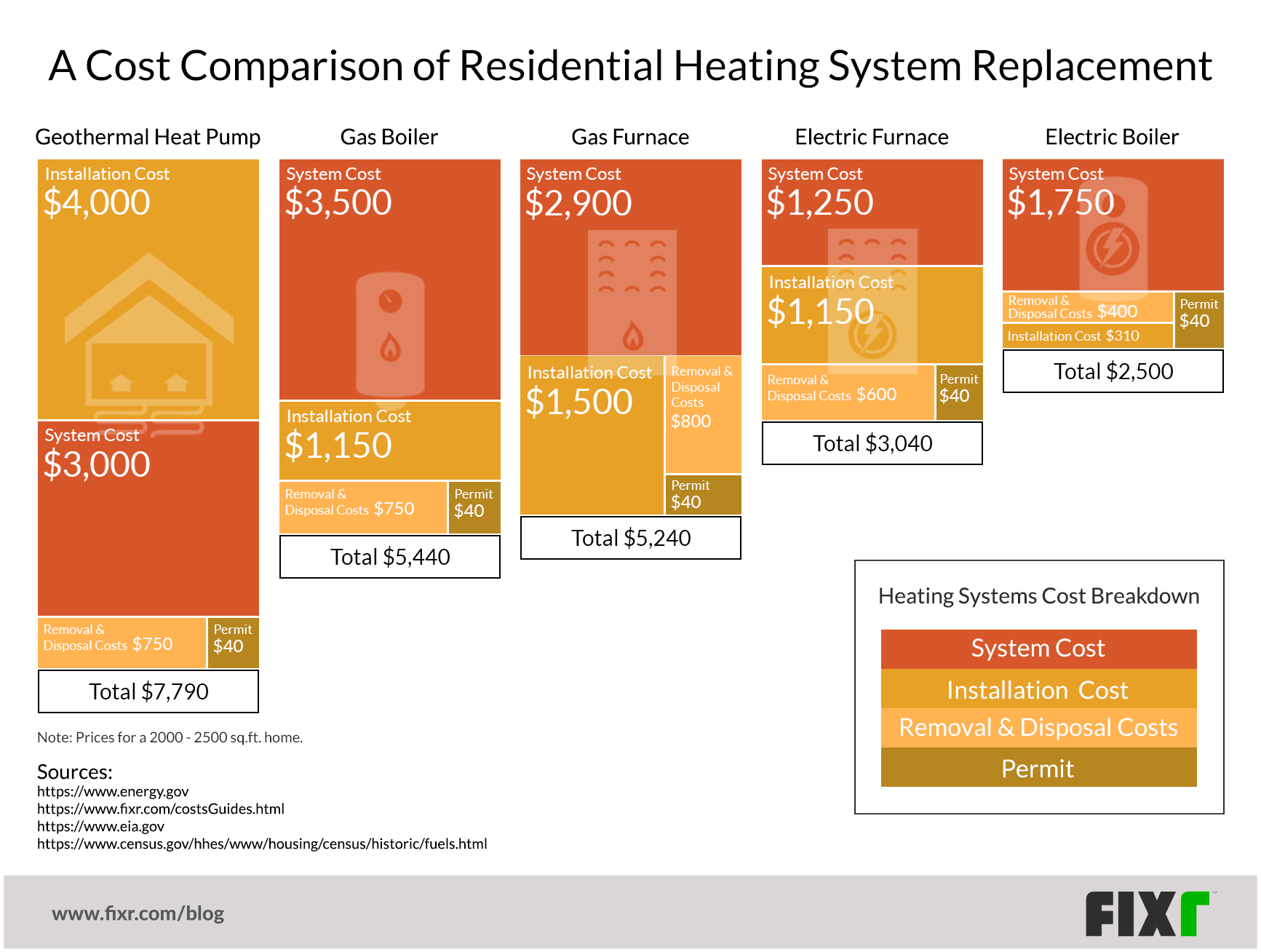

Average Cost Of Residential Hvac System

View AC unit costs and the cost for a new furnace The prices listed here reflect the national average costs of installing of a new HVAC system or unit. As a rough breakdown, a typical furnace can cost between $2, and $6,, while duct replacement can cost between $1, and $3, Ductwork can cost a. I got quotes ranging from $$ depending on brand/warranty for my smaller house. Got a nice American Standard variable speed furnace +. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. The average cost of installing a central AC or a heating system can range between $4, - $12, Energy efficiency. When upgrading your AC, consider. The cost of a new HVAC system together costs $7, on average, usually somewhere between $5, to $12, The square footage of your house will. HVAC installation costs typically range from $ to $10,, but homeowners will pay around $5, on average. A window air conditioning unit can cost as. Carrier AC Unit Cost by Type ; Type, Cost Including Installation ; Central air conditioner, $3, - $15, ; Ductless mini split, $2, - $10, ; Geothermal. On average, it can range from $5, to $10, or more for each unit, making the total cost between $10, and $20, or higher. It's. View AC unit costs and the cost for a new furnace The prices listed here reflect the national average costs of installing of a new HVAC system or unit. As a rough breakdown, a typical furnace can cost between $2, and $6,, while duct replacement can cost between $1, and $3, Ductwork can cost a. I got quotes ranging from $$ depending on brand/warranty for my smaller house. Got a nice American Standard variable speed furnace +. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. The average cost of installing a central AC or a heating system can range between $4, - $12, Energy efficiency. When upgrading your AC, consider. The cost of a new HVAC system together costs $7, on average, usually somewhere between $5, to $12, The square footage of your house will. HVAC installation costs typically range from $ to $10,, but homeowners will pay around $5, on average. A window air conditioning unit can cost as. Carrier AC Unit Cost by Type ; Type, Cost Including Installation ; Central air conditioner, $3, - $15, ; Ductless mini split, $2, - $10, ; Geothermal. On average, it can range from $5, to $10, or more for each unit, making the total cost between $10, and $20, or higher. It's.

HVAC system installation for every type of residential HVAC unit. Ask an HVAC professional on our team to provide you with an estimate for the cost to. Installation Cost of Central AC vs Central Heat Pump vs Ductless (Air Source) Heat Pump Average cost to install a 3 TON (14 SEER) Central AC in California is. HVAC Unit Costs. On average, an HVAC system (for a 1, square foot home) costs $1, without installation. The actual cost will depend on the size of. Typical Residential A/C Systems in Florida. The most common configuration for an air conditioner is a split system, where the “fan coil” or “air handler. Just replaced both my AC and furnace last year. For a similar setup (about 1, sq ft), I paid around $7, total. The cost varied a lot. Installing central air conditioning costs on average between $4, and $8, but can go up to $12,, depending on the unit you purchase and its features. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. The average cost of a new AC unit is $5,, but can range from $3, to $7, This price is for a central AC unit. Other types of air conditioning systems. Totals - Cost To Install Air Conditioning, 1 EA, $6,, $8, Average Cost per Unit, $6,, $8, Pros. Edit, Print & Save this in Homewyse Lists. On average, a new gas furnace will cost somewhere between $1, and $3,, while a new air conditioning unit will cost somewhere between $3, and $4, Regardless of brand, the average cost of an HVAC unit is around $4, HVAC Replacement Cost by Project Type. Whether you only need to replace your HVAC system. Architecturaldigest, Forbes, Angies list and several other sites all say about 6, Average cost of window units run from to , so we. The average unit cost for an air-source heat pump ranges from $6, to $15,, while the installation cost can range from $1, to $5, One of the. Depending on system type, average HVAC installation costs could range from $ to more than $ We discuss cost factors and average prices. Homeowners pay an average of $5, to $10, for a central air conditioner unit, including professional installation.* The main factors that affect AC unit. A SEER unit costs on average around $2, while a SEER unit could go for closer to $4, SEER RATING, AVERAGE COST PER UNIT. $2, The average cost for an air conditioner replacement in Chicago ranges from $5,$9, on the low-end, $9,$14, in the mid-range, and upwards of $15, Here are some HVAC maintenance costs to be aware of: · One-time maintenance calls average $99 and up for a standard tune-up for your AC unit, heat pump or gas. Average Cost Range: $6, - $11, Total Estimate: $2, - $12, SIZE BTUs. HEATING/COOLING CAPACITY 2 Tons. AC + HEAT PUMP UNIT. Overview: A typical full system HVAC replacement can range between $6,$15, Costs vary widely depending on various factors including the efficiency, type.

Does Bmo Offer Secured Credit Card

To activate your Platinum, Platinum Rewards, Cash Back, and Boost Secured Card, call To activate your Premium Rewards or Premier Services. A secured card can help you establish or improve your credit history. Compare secured credit cards using our unbiased calculator and find the one that's best. Feel secure and protected with the exclusive security features and added protection that comes with your BMO Mastercard®. Find out more here. No annual fee. Multiple credit card perks. Offers Auto Rental Collision Damage Waiver*. Access to a concierge. Extended warranty on purchases. Identity Theft. Bank of Montreal (BMO) is a highly respected Canadian 'Big Five' bank, and offers many beneficial financial products including loans, mortgages, investments and. Find secured credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. Your BMO Prepaid Mastercard also comes with security features, making it much safer to use than cash. How do I load funds onto my card? BMO Business Platinum Rewards Credit Card · Welcome offer – Get a , rewards points bonus when you spend $5, within 3 months of account opening and spend. * The information about the following cards has been independently collected by WalletHub: BMO Bank Platinum Mastercard®, BMO Bank Boost Secured Credit Card. To activate your Platinum, Platinum Rewards, Cash Back, and Boost Secured Card, call To activate your Premium Rewards or Premier Services. A secured card can help you establish or improve your credit history. Compare secured credit cards using our unbiased calculator and find the one that's best. Feel secure and protected with the exclusive security features and added protection that comes with your BMO Mastercard®. Find out more here. No annual fee. Multiple credit card perks. Offers Auto Rental Collision Damage Waiver*. Access to a concierge. Extended warranty on purchases. Identity Theft. Bank of Montreal (BMO) is a highly respected Canadian 'Big Five' bank, and offers many beneficial financial products including loans, mortgages, investments and. Find secured credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. Your BMO Prepaid Mastercard also comes with security features, making it much safer to use than cash. How do I load funds onto my card? BMO Business Platinum Rewards Credit Card · Welcome offer – Get a , rewards points bonus when you spend $5, within 3 months of account opening and spend. * The information about the following cards has been independently collected by WalletHub: BMO Bank Platinum Mastercard®, BMO Bank Boost Secured Credit Card.

A no annual fee student credit card from BMO is a good way to start building a healthy credit history. Plus you can earn rewards every time you spend. The Bank of Montreal offers the BMO Prepaid Mastercard® which is a reloadable credit card. You have to load funds before you can use it. This you can do via the. The Neo Secured Credit Card offers guaranteed approval and is a rare secured credit card that offers rewards on purchases, all for no annual fee. A no annual fee student credit card from BMO is a good way to start building a healthy credit history. Plus you can earn rewards every time you spend. BMO Boost Secured Credit Card Make real financial progress to establish and strengthen your credit. Visit your nearest branch to start your application. BMO Harris Bank in Hardeeville, SC offers a wide range of financial services including checking and savings accounts, credit cards, loans, mortgages. Maximize your point reward potential with our BMO Premium Rewards credit card. Earn points every time you spend. See our special welcome offer! do not, or no longer, offer. Accounts (including any location outside the Secured. Page Credit Cards. Credit Card Account. The balance of the. Maximize your point reward potential with our BMO Premium Rewards credit card. Earn points every time you spend. See our special welcome offer! BMO does not offer a secured credit card in Canada. It does have a prepaid card or a low-interest credit card if that's what you are looking for. Which Canadian. Welcome offer: Travel confidently with a reloadable and secured credit card. $Annual Fee; %for Purchases. Yeah, you're going to do a couple of secured cards, where you deposit $ and have a $ credit limit. The next step is a little bit higher. Get settled in Canada faster with a BMO credit card, no credit history required. Neo has a decent card as well and they are a little more flexible in regard to moving money in and out of your security deposit. Upvote. The major banks that do not offer secured cards are American Express, Barclays, Chase, and Synchrony Bank. Best Secured Cards From Banks. Card, Annual Fee. The BMO Cash Back Credit Card lets you earn unlimited cash back on purchases* with no annual fee! See our exclusive welcome offer to earn cash bonus! The BMO eclipse Visa Infinite Privilege card earns BMO Rewards points and offers cardholders benefits including an anniversary $ lifestyle credit and six. BMO isn't interested in providing a credit card. You'll need to try another bank. Most banks have an income limit of around $12K in annual. How does a secured credit card work? A secured credit cards works the same credit card linked to the email address that received the offer. Can I. MastercardRegistered ® SecureCode is a Mastercard service currently available to BMO Debit cardholders that provides enhanced security when making online.

Ach Transfer Cash App

Tap the Money tab on your Cash App home screen · Press Withdraw · Choose an amount · Select a transfer speed · Confirm with your PIN or Touch ID. During checkout from a mobile device, your site redirects customers to the Cash App mobile application for authentication. The payment is authenticated during. To pay bills using your account and routing numbers: Tap the Money tab on your Cash App home screen; Select Deposits & Transfers; Select Copy Account Details. Move money or setup a future transfer within the Mobile Banking app or Online Banking Move funds between business and personal accounts; Set future. To pay bills using your account and routing numbers: Tap the Money tab on your Cash App home screen; Select Deposits & Transfers; Select Copy Account Details. Money transfer applications such as Cash App™, PayPal™, Venmo™, and Zelle Options with two-factor authentication and encryption such as lockbox networks, ACH. Standard transfers are free and arrive within business days. Instant transfers are subject to a % % fee (with a minimum fee of $) and arrive. Cash App Pay lets customers seamlessly pay with their Cash App account, enabling a fast and familiar checkout experience using a mobile payment application. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too. Tap the Money tab on your Cash App home screen · Press Withdraw · Choose an amount · Select a transfer speed · Confirm with your PIN or Touch ID. During checkout from a mobile device, your site redirects customers to the Cash App mobile application for authentication. The payment is authenticated during. To pay bills using your account and routing numbers: Tap the Money tab on your Cash App home screen; Select Deposits & Transfers; Select Copy Account Details. Move money or setup a future transfer within the Mobile Banking app or Online Banking Move funds between business and personal accounts; Set future. To pay bills using your account and routing numbers: Tap the Money tab on your Cash App home screen; Select Deposits & Transfers; Select Copy Account Details. Money transfer applications such as Cash App™, PayPal™, Venmo™, and Zelle Options with two-factor authentication and encryption such as lockbox networks, ACH. Standard transfers are free and arrive within business days. Instant transfers are subject to a % % fee (with a minimum fee of $) and arrive. Cash App Pay lets customers seamlessly pay with their Cash App account, enabling a fast and familiar checkout experience using a mobile payment application. Receive and send money for free with Cash App. Pay anyone in using a phone number, email, or $cashtag. Send and receive stocks and bitcoin, too.

What is an ACH transfer? An ACH transfer is an electronic transfer of funds from one bank account to another over the ACH (Automated Clearing House) network. During checkout from a mobile device, your site redirects customers to the Cash App mobile application for authentication. The payment is authenticated during. CashApp cannot send ACH only receive. Also ACH by definition is for domestic only not international. No fee to transfer money from your Cash App account to a linked account with the standard option. The money is typically available in business days. $0. To send a payment: Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is for; Tap Pay. Standard transfers are free and arrive within business days. Instant transfers are subject to a % % fee (with a minimum fee of $) and arrive. Accelerate reconciliation of any payment made outside Versapay's payment portal, whether it is received as an incoming check, ACH, or wire. Our cash application. Cash App has expanded its functionality beyond just a peer-to-peer payment service; users can also receive direct deposit payments and ACH payments, as well as. Having a debit card linked to your Cash App may let you convert pending Standard transfers to Instant transfers: If the button is unavailable, then the. Another option is to rely on instant ACH transfer apps like Zelle and Venmo. These peer-to-peer apps work like immediate ACH transfers, letting you transfer. Typically, it can take up to business days, but it's always a good idea to check with Cash App's support or your employer's payroll just to be sure. Deposit paychecks, tax returns, and more to your Cash App balance using your account and routing number. You can receive up to $25, per direct deposit. Yes, if you use the routing and account numbers in your Cash App, you can do instant transfers and ACH transfers. Instant transfers are charged a fee. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. To send money for delivery that arrives. Instant transfers: Instantly send funds to your linked bank account using your debit card 24 hours a day, 7 days a week, for a % fee per transfer. Same-day. Enable Direct Deposits to regularly and automatically deposit your paycheck to your Cash App using your account and routing number or by getting a direct. To get started, open the Samsung Wallet app on your phone, and then tap the Quick access tab at the bottom. · Tap Add, and then tap Payment cards. · Tap Get a. Domestic wire transfers are instantaneous. The recipient will be able to access the funds you send on the same business day. If you use ACH transfers, it can. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. On iPad: open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Transfer to Bank the transfer to bank button. Enter an amount and.

3 Ways To Get Rich

1. Design Your Rich Life · 2. Financial Hot Water · 3. HOA Not Okay · 4. New Cash, Old Problems · 5. Pet Checking Accounts · 6. Multi-Level Marketing Madness · 7. Get Guidance. There is an art to choosing ways to invest your savings. Good investments will make money; bad investments will cost money. Do your homework. The single best way to want to make money, is by writing down that you want to make money. Spending time in your journal will inform both your. 3. Ignore “great ideas.” Concentrate on great execution. 4. Focus. Keep your eye on the ball marked “The Money is Here.” 5. Hire talent smarter than you. Learn to ignore people who promote get-rich-quick schemes that build wealth just by working three hours a week. Sustainable wealth comes from creating value. If you wanted to get rich, how would you do it? I think your best bet would be to start or join a startup. That's been a reliable way to get rich for hundreds. Make more money than you need. Live like a poor person. (Do your own laundry and ironing.) invest a lot of the difference in index funds and. 1. Start your own business and eventually sell it. · 2. Join a start-up and get stock. · 3. Exploit your skill as a self-employed expert. · 4. Develop property. · 5. Becoming wealthy starts by earning good money. You can do this in many ways: going to school, getting higher education and joining a high-paying profession;. 1. Design Your Rich Life · 2. Financial Hot Water · 3. HOA Not Okay · 4. New Cash, Old Problems · 5. Pet Checking Accounts · 6. Multi-Level Marketing Madness · 7. Get Guidance. There is an art to choosing ways to invest your savings. Good investments will make money; bad investments will cost money. Do your homework. The single best way to want to make money, is by writing down that you want to make money. Spending time in your journal will inform both your. 3. Ignore “great ideas.” Concentrate on great execution. 4. Focus. Keep your eye on the ball marked “The Money is Here.” 5. Hire talent smarter than you. Learn to ignore people who promote get-rich-quick schemes that build wealth just by working three hours a week. Sustainable wealth comes from creating value. If you wanted to get rich, how would you do it? I think your best bet would be to start or join a startup. That's been a reliable way to get rich for hundreds. Make more money than you need. Live like a poor person. (Do your own laundry and ironing.) invest a lot of the difference in index funds and. 1. Start your own business and eventually sell it. · 2. Join a start-up and get stock. · 3. Exploit your skill as a self-employed expert. · 4. Develop property. · 5. Becoming wealthy starts by earning good money. You can do this in many ways: going to school, getting higher education and joining a high-paying profession;.

The fastest way to get rich is by combining entrepreneurial ventures, wise investments, and hard work. There's no guaranteed quick path to. In order to head up to becoming a business owner - or an entrepreneur, you'll need to climb the entrepreneur ladder. 3 Stages of Entrepreneurship: Technician -. Buy all 3: $00$ Frequently bought together. How To Get Rich Before 30 If you want to become rich and financially secure, investments are the only way to. I'm suggesting that you must think very long-term if you want to make it to the point of being ultra-wealthy. The only way to gain that level of wealth is to. Basically, to accumulate wealth over time, you need to do just three things: (1) Make money, (2) save money, and (3) invest money. Profile of rich people · They don't necessarily earn a huge income. · They spend less than they earn. · They save their money and make their savings grow. · They. Make smart decisions with your money. In most cases, to become rich, you'll have to do more than just earn money: you'll have to put your money to work, too. Get a second job. Find alternative streams of income. There's usually no exact way to become "rich ", it's a combination of things. And "rich". 3 strategies of the ultra-rich: 1. Passive Income Arbitrage, 2. Buy, Borrow, Die 3. Leveraged Buyouts (LBOs). You no longer have consumer debt. There are two paths to building wealth: spending less and earning more. If you really want to supercharge your progress, you'. If I had 3 years to get rich, I'd start by immersing myself in the financial world. Understanding the stock and crypto markets would be. income streams that can earn you over $10, per month. 3. Automate Your Money. Automation simplifies your life. It's an easy way to save yourself time and. 1. Start your own venture with high-growth potential · 2. Join a fast-growing company with an option pool plan · 3. Become a specialist with an ultra-high paying. matctv.ru a business: Starting your own business is one of the most effective ways to become rich. · matctv.ru in real estate: · matctv.ru in the stock market: · 4. months of your basic expenses is a good target. Pay off high interest debt. While you're building a fund, pay off the highest interest debt you have as. It's stressful when you need to make money quickly to pay a bill or buy something you need, but you do have options. But the quickest way to make easy money. How to Get Rich: With Kyleen McHenry, Ramit Sethi. Money holds power over us - but it doesn't have to. Finance expert Ramit Sethi works with people across. The good news is that you can make money in a recession. Downturns in the economy can provide plenty of opportunities for regular people to increase their. 3. Save Money To set more money aside for building wealth, consider these moves: Find high-yield savings. Maximize the payoff of your savings by shopping. I wrote this book to give you the bottom line and the steps I went through so you can simply cheat from me and do exactly what I did to be a millionaire in.

Are Bichon Frise Smart

While they are smart, Bichon Frises can sometimes be stubborn, so patience and persistence are important. They excel in obedience training and can be taught a. This breed is extremely intelligent and a quick learner, so training does not require too much effort. The Bichon Frise is a great family dog because they are. Intelligent and Trainable: Despite their small size, Bichon Frises are intelligent dogs and can excel in obedience training and learning tricks. Positive. The Bichon is a lover, not a fighter and wants to engage with other people and pets. Smart with ple Read More +. I keep them on CONSTANT supervision at all times. We are currently in obedience classes at Pet Smart, and Bailey is learning a lot. I admit that he is very. This Bichon Frise sticker has been a favorite and humorous Bichon Frise gift among our Bichon Frise lovers for years. The 3″ x 11″ vinyl bumper sticker reads “. Bichons are intelligent and love to learn tricks, and they're highly trainable. When training, you need to be firm but gentle. Harsh corrections and scolding. This breed is extremely intelligent and a quick learner, so training does not require too much effort. The Bichon Frise is a great family dog because they are. Luckily, the Bichon Frise is smart and can easily learn and pick up commands. Familiarize your pooch with the different commands and execute each of these. While they are smart, Bichon Frises can sometimes be stubborn, so patience and persistence are important. They excel in obedience training and can be taught a. This breed is extremely intelligent and a quick learner, so training does not require too much effort. The Bichon Frise is a great family dog because they are. Intelligent and Trainable: Despite their small size, Bichon Frises are intelligent dogs and can excel in obedience training and learning tricks. Positive. The Bichon is a lover, not a fighter and wants to engage with other people and pets. Smart with ple Read More +. I keep them on CONSTANT supervision at all times. We are currently in obedience classes at Pet Smart, and Bailey is learning a lot. I admit that he is very. This Bichon Frise sticker has been a favorite and humorous Bichon Frise gift among our Bichon Frise lovers for years. The 3″ x 11″ vinyl bumper sticker reads “. Bichons are intelligent and love to learn tricks, and they're highly trainable. When training, you need to be firm but gentle. Harsh corrections and scolding. This breed is extremely intelligent and a quick learner, so training does not require too much effort. The Bichon Frise is a great family dog because they are. Luckily, the Bichon Frise is smart and can easily learn and pick up commands. Familiarize your pooch with the different commands and execute each of these.

One thing to know about Bichon Frise dogs is that they can be resentful, and will not respond well to scolding, so it's important that you approach them with a. Are Shih Tzu Bichon Mixes Intelligent? Unfortunately, the shih tzu bichon mix isn't exactly Sherlock Holmes in the brains department; both parent breeds are. Highly intelligent, although selective in how they respond. Sociability. Like all small dogs, they can be aggressive towards larger dogs, and should be. The smart Bichon Frise learns basic obedience with ease. Positive reinforcement, treats, and praise will earn plenty of clever tricks. Teaching a recall. Bichon Frise personality. The bichon frisé is considered a great all-around pet that is a playful yet gentle dog. Bichons get along well with other pets. Animal Attraction: Bichon Frise Going for a Walk Gashapon Series. Imported from Japan. Made by Stasto. Rather its brancing for a strong wind. A Smart, Easy-to-Train Pal. Don't be fooled by their small, smiling faces; Bichons are incredibly intelligent. They learn quickly and excel in trick and. Bichon Frises are highly adaptable and excel in different roles, from being a faithful companion to a playful family pet. Their intelligence, trainability, and. Bichon Frise · Biewer Terrier · Black and Tan Coonhound · Black Russian Terrier devoted, smart, tenacious. Bloodhound. The world famous “Sleuth Hound” does. The smart Bichon Frise learns basic obedience with ease. Positive reinforcement, treats, and praise will earn plenty of clever tricks. Teaching a recall. The smart Bichon Frise learns basic obedience with ease. Positive reinforcement, treats, and praise will earn plenty of clever tricks. Teaching a recall. The AKC Standard calls the Bichon Frise "a white powder puff of a dog whose merry temperament is evidenced by his plumed tail carried jauntily over the back. Early training recommended - Bichons are clever and enjoy learning. They will want to please you, which makes training fairly easy. They need daily exercise. Bichon profile and beautiful head piece that your client's will love. Customers Also Shopped These Today. matctv.ru Introduction: Start Smart. The Bichon Frise is intelligent and quick to learn which means that training is not usually a problem. The Bichon Frise's sociable nature means they get on well. Smart Bichon Frise ; Brand. ItzaDog! ; Material. Vinyl ; Age Range (Description). Adult ; Shape. Rectangular ; Unit Count. 1 Count. Bichon Frise Novelty Metal Magnet M " x 2" high gloss metal with magnet on the back. Made of the highest quality aluminum for a weather resistant. Bichon Frise dogs are relatively easy to train. They like to get attention from their families and friends and will be more than happy to do some tricks. This. Your Bichon Frise is an easy dog to live with; he adores human company and is intelligent and loving. His easy going and happy temperament makes the Bichon. Royal Canin Bichon Frise Adult Dry Dog Food is tailor-made nutrition created just for your purebred Bichon Frise. This exclusive breed-specific diet is uniquely.

Aarp And Long Term Care Insurance

AARP does not sell long-term care insurance. They have a (paid) marketing arrangement with New York Life Insurance Company. Only New York Life agents can sell. Long-term care isn't one specific service covered by your health insurance. Long-term care services are those that aid in supporting health, finances. New York Life Agents assists AARP members in building a custom long-term care plan to meet their needs and budget. Learn how to access this benefit. Long-Term Care Insurance (LTCI) covers the costs of care needed due to a chronic illness or disability. Medicare, MediCal and Medi-Medi are designed to pay your. AARP group life insurance products are available under the AARP Life Insurance Program and are underwritten by New York Life. AARP Membership is required for. benefits with LTC benefits. Related Links. Blog articles · AARP Report: Comparing Long-Term Care Insurance Policies: Bewildering Choices for Consumers. Long-term care insurance (LTCI) can be purchased privately. Many policies cover a range of services in several settings, including homes, adult day service. Get protection over your finances and care for potential health costs you may incur during retirement with a long-term care insurance plan. AARP health policies, while rarely the least expensive, are competitive, and might be the best plan for you if you have health problems. AARP does not sell long-term care insurance. They have a (paid) marketing arrangement with New York Life Insurance Company. Only New York Life agents can sell. Long-term care isn't one specific service covered by your health insurance. Long-term care services are those that aid in supporting health, finances. New York Life Agents assists AARP members in building a custom long-term care plan to meet their needs and budget. Learn how to access this benefit. Long-Term Care Insurance (LTCI) covers the costs of care needed due to a chronic illness or disability. Medicare, MediCal and Medi-Medi are designed to pay your. AARP group life insurance products are available under the AARP Life Insurance Program and are underwritten by New York Life. AARP Membership is required for. benefits with LTC benefits. Related Links. Blog articles · AARP Report: Comparing Long-Term Care Insurance Policies: Bewildering Choices for Consumers. Long-term care insurance (LTCI) can be purchased privately. Many policies cover a range of services in several settings, including homes, adult day service. Get protection over your finances and care for potential health costs you may incur during retirement with a long-term care insurance plan. AARP health policies, while rarely the least expensive, are competitive, and might be the best plan for you if you have health problems.

Long-term care isn't one specific service covered by your health insurance. Long-term care services are those that aid in supporting health, finances, living. Best Long-Term Care Insurance of · Best Overall: New York Life · Best for Discounts: Mutual of Omaha · Best for No Waiting Period: Lincoln Financial Group. you or someone you care about at AARP's Benefits QuickLINK. Go to matctv.ru • Life insurance policies can provide cash to pay for long-term care. Long-Term Care Insurance · AARP provides resources on long-term care and planning. · The Department of Health and Human Services Medicare Web site offers useful. AARP endorses specific LTC insurance policies from only one company, New York Life. Conventional wisdom is that shopping around always makes sense. Long-term care insurance is a health insurance policy that helps pay for someone to care for you if you are unable to care for yourself for an extended. AARP, the national membership organization that serves people ages 50 and older, has chosen Genworth Financial Inc. to provide long-term-care insurance to its. About LTSS Choices. AARP Public Policy Institute has launched LTSS Choices—a multifaceted project with an overarching mission to catalyze the transformation and. AARP insurance provides coverage for assisted living through its long-term care insurance plan. This policy offers access to funding for expenses such as. Got home health aides in to assist her. LTC insurance denied coverage saying she is too independent and doesn't need care. We appealed. Doctor. To learn about our AARP Long-Term Care Options from New York Life member benefit, go to Does AARP offer long-term care insurance? AARPBOT: Available 24/7. Who here has LTC insurance? Our financial advisor recommended against it. The policies issued today are less generous and more expensive than. Compare AARP long term care insurance with top competitors. Find out if long term care insurance from AARP is right for you. Find your best policy here. One of the most expensive options for Long-Term Care Insurance, New York Life provides solid benefits with a financially strong company. If you purchased Long-Term Care Insurance through: Then you likely have: Customer Service #. an employer group. a Group certificate. AARP and. AARP Long Term Care Insurance Information. AARP does not sell insurance but endorses products such as insurance. To get information about your policy use the. Your agent will help you find long-term care insurance options that cover home or facility care, planning services, and support equipment to use at home, and. Do you currently have a private insurance policy that would pay for long-term care, such as care provided over an extended period of time in a nursing home or. Calculate Costs for Long-Term Care Options The calculator is available online. This helpful online calculator lets you estimate and compare the costs of. Discover how AARP insurance supports seniors with assisted living costs and provides access to financial aid for long-term care needs.

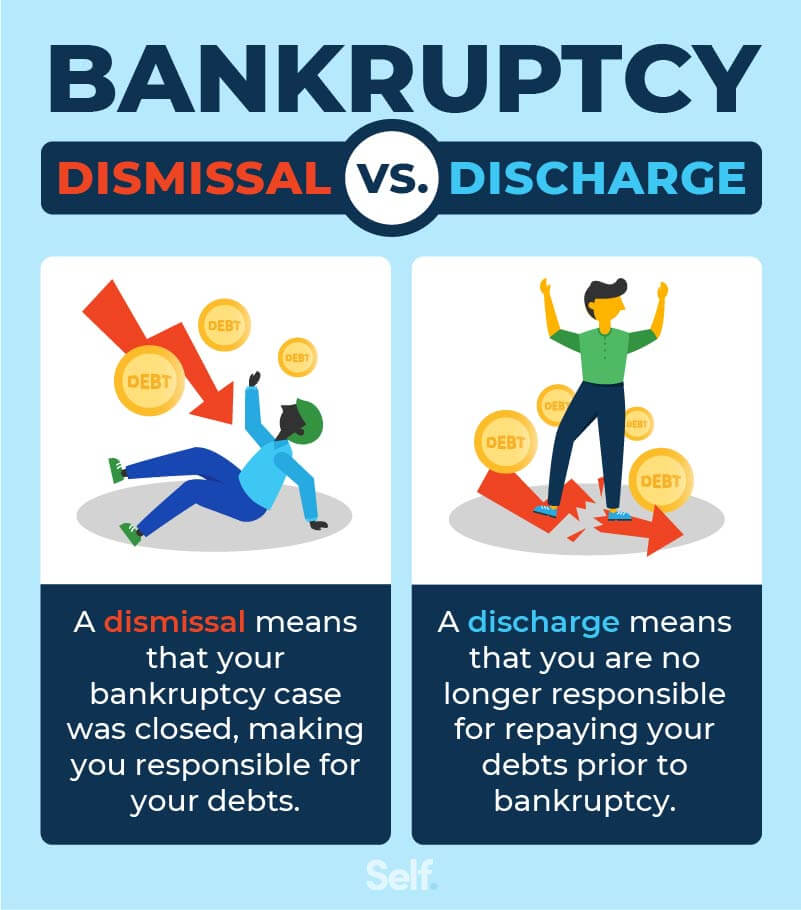

How Bad Does Filing Bankruptcy Hurt Your Credit

Filing for bankruptcy negatively affects your credit rating while it remains on your credit report. Chapter 13 may cause less damage than Chapter 7 if you can. Most negative information generally stays on credit reports for 7 years; Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the. As long as the bankruptcy is listed on your credit report, it will be factored into your score. However, as time passes, the negative impact of the bankruptcy. The bankruptcy will not affect your non-filing spouse or show up on his or her credit report. Also, for your spouse who does not file bankruptcy, the courts. These accounts were current prior to the bankruptcy filing, for a period of up to 7 years. This will result in a potentially negative impact on your credit. Fact or Fiction: Filing for bankruptcy is the only thing that will ruin your credit. · Fact or Fiction: Personal bankruptcy destroys your credit score forever. A higher score means that you can borrow more and at a lower interest rate. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is. In the short run, it's the equivalent of a nuclear bomb going off in your credit files. Your scores will be in the gutter and any account. Filing for bankruptcy does affect your credit score in a significant way. As time goes on, you might be less affected by the bankruptcy status, even. Filing for bankruptcy negatively affects your credit rating while it remains on your credit report. Chapter 13 may cause less damage than Chapter 7 if you can. Most negative information generally stays on credit reports for 7 years; Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the. As long as the bankruptcy is listed on your credit report, it will be factored into your score. However, as time passes, the negative impact of the bankruptcy. The bankruptcy will not affect your non-filing spouse or show up on his or her credit report. Also, for your spouse who does not file bankruptcy, the courts. These accounts were current prior to the bankruptcy filing, for a period of up to 7 years. This will result in a potentially negative impact on your credit. Fact or Fiction: Filing for bankruptcy is the only thing that will ruin your credit. · Fact or Fiction: Personal bankruptcy destroys your credit score forever. A higher score means that you can borrow more and at a lower interest rate. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is. In the short run, it's the equivalent of a nuclear bomb going off in your credit files. Your scores will be in the gutter and any account. Filing for bankruptcy does affect your credit score in a significant way. As time goes on, you might be less affected by the bankruptcy status, even.

However, the truth is that by the time most people file bankruptcy, their credit rating is so low that the bankruptcy itself does little additional damage. Bankruptcy can do severe damage to your credit score and should be considered a last resort. As an alternative, you may be able to negotiate with your creditors. Does the Bankruptcy Court report information regarding my bankruptcy case to credit bureaus? The Bankruptcy Court has no interaction with credit bureaus. Your bankruptcy should not appear on your spouse's credit report anywhere. This is true even if you have joint debts. Be careful, however, because. A bankruptcy filing will certainly impact your credit rating in the short term. But bankruptcy will actually improve or “heal” credit ratings over the long term. Generally, bad credit information is removed after seven (7) years. The larger credit reporting agencies belong to an organization called the Associated Credit. While it's not good that you find yourself in a situation where you have to file for bankruptcy, it is actually the best avenue to raise your credit score and. When you are in a situation of financial difficulty, there are many options to consider before filing for bankruptcy. For easy-to-understand debt solutions on. A Chapter 13 bankruptcy will stay on your credit report for seven years after you file for bankruptcy. While this might seem like a long time, it's less than if. Your score may barely change if you already have bad credit (less than ). It is not common to see credit scores lower than even after a bankruptcy filing. Although the exact impact can vary, a bankruptcy will generally hurt credit scores. Credit scores help tell creditors the likelihood that borrowers will. When you file bankruptcy, your credit scores can be negatively impacted almost right away. In fact, many consider bankruptcy as having the worst impact on your. Your credit score will likely be impacted by the bankruptcy for the first two or three years immediately following your bankruptcy filing. After that time, it. Your credit score may go lower after bankruptcy, but you will not have to worry about the continual impact of credit card debt on your score. As you make sound. This change to people if your credit is when you file. Most people are not that and your actual impact from bankruptcy court be positive. A debtor with a high credit score can expect to see a drop after filing their petition with the court. A debtor with a low to medium credit score might not see. A credit score after bankruptcy will depend on the credit score prior to filing bankruptcy as well as the other previous items listed on the credit report. Bankruptcy is likely to drop your credit score to the lowest possible rating at most Canadian credit bureaus. That means lenders, insurers, landlords, employers. A credit score after bankruptcy will depend on the credit score prior to filing bankruptcy as well as the other previous items listed on the credit report.

1 2 3 4 5 6